Automatically Track Your Clients' Rates with Sherlok's RateTraker

Proactively Manage Your Clients’ Loans—

Post-Settlement, Prospecting, and Beyond

What is Sherlok's RateTraker?

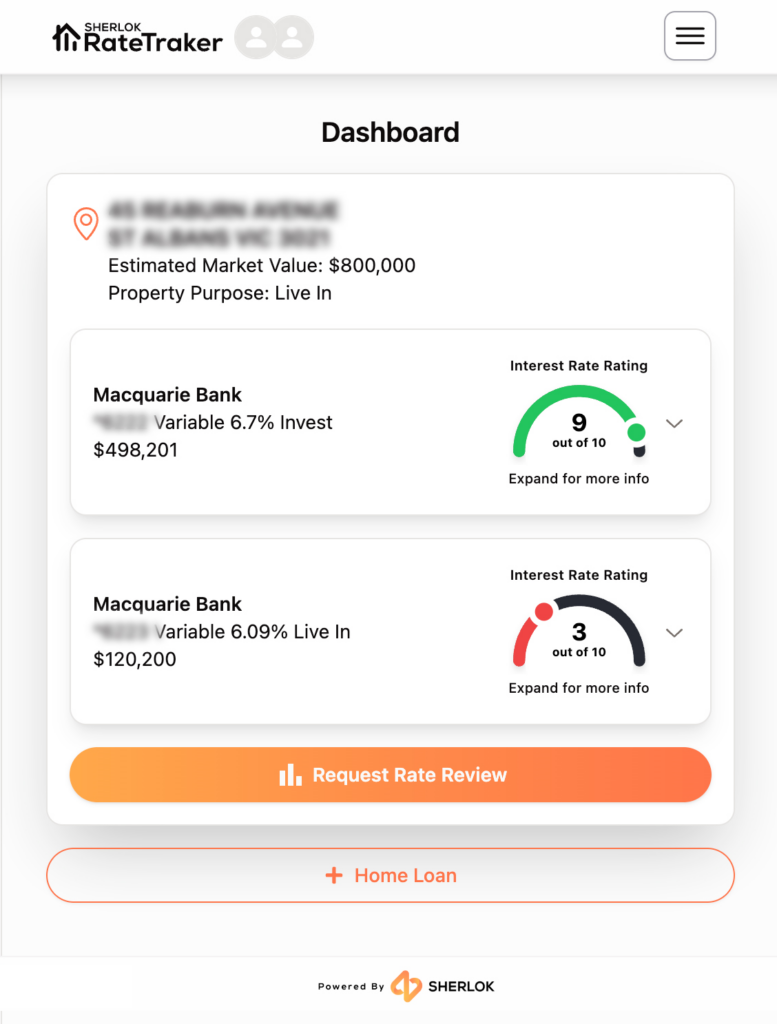

Sherlok’s RateTraker is an automated tool that helps mortgage brokers monitor their clients’ interest rates after settlement. By using open banking, RateTraker alerts you when a client’s loan rate becomes uncompetitive, giving you the chance to act fast and secure better terms for them.

How Does Sherlok’s RateTraker Work?

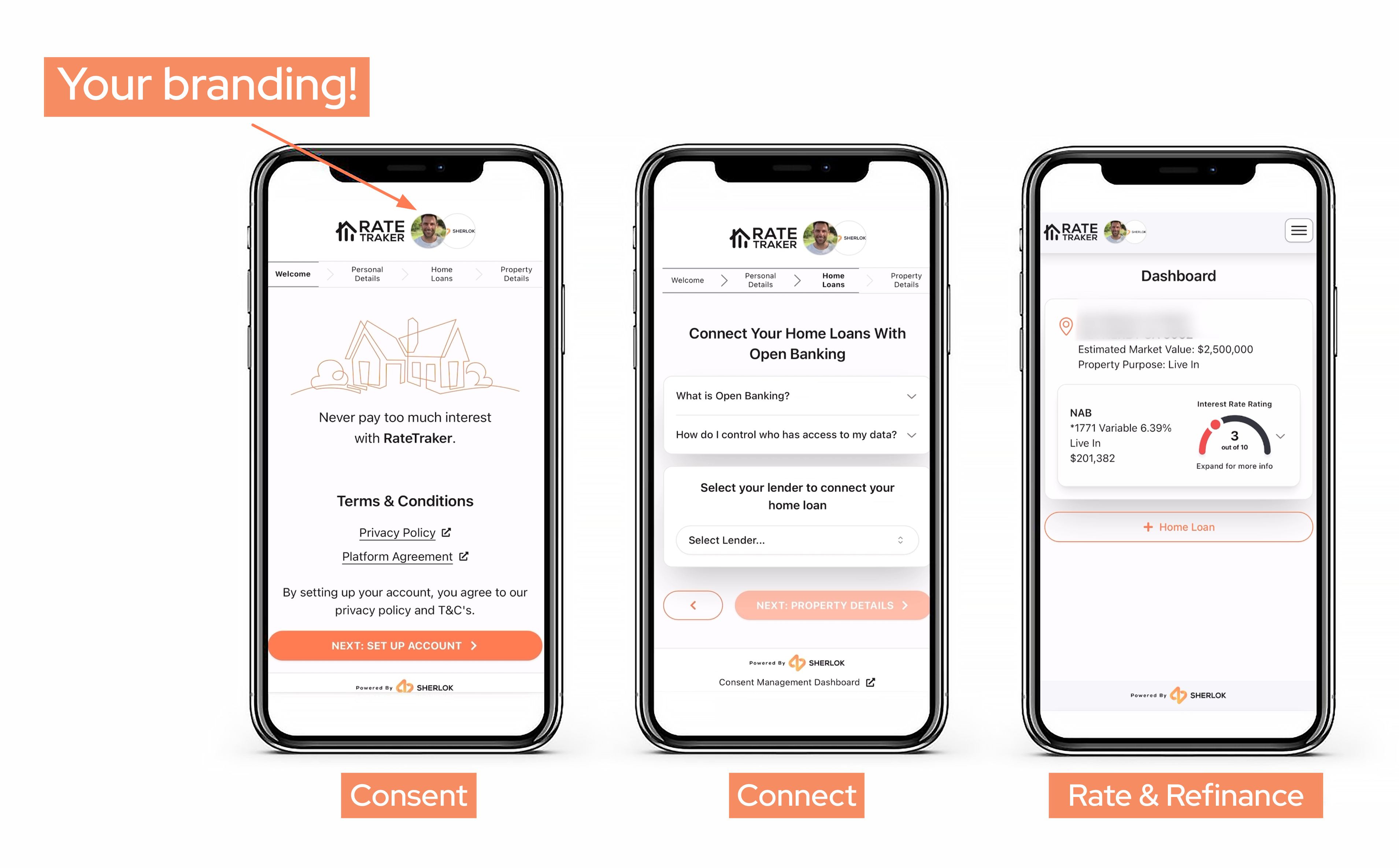

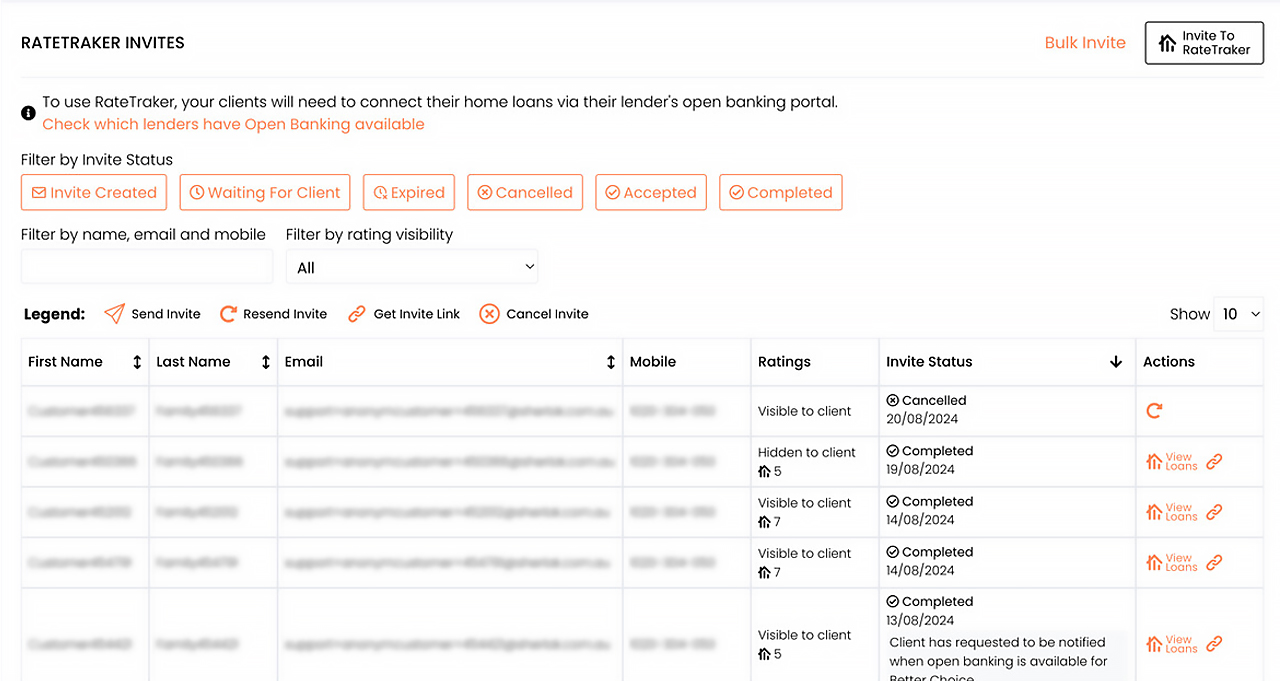

- Client Consent: Invite your clients to share their loan data securely via Sherlok’s RateTraker platform, using open banking.

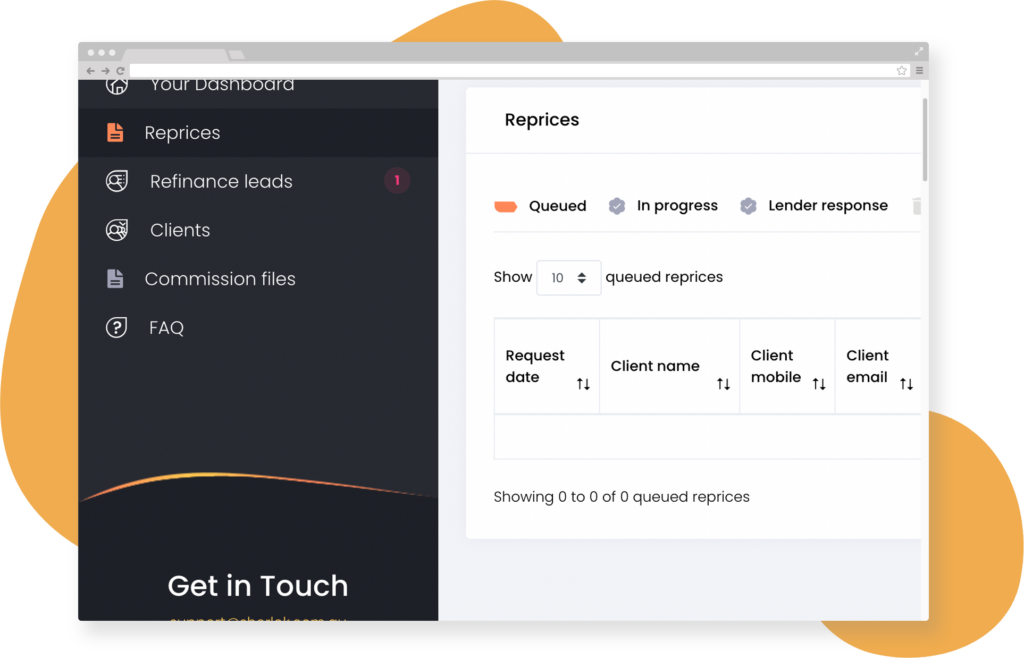

- Automated Rate Monitoring: RateTraker continuously tracks your clients’ interest rates and notifies you when their rates become uncompetitive.

- Proactive Notifications: You receive an alert when a rate review is due, so you can request a better deal from the client’s current lender.

It’s that easy. You’re always in control, but Sherlok’s RateTraker ensures you never miss a rate change that could save your client money.

Why Sherlok’s RateTraker Benefits You as a Broker:

- Boost Client Retention: Stay top of mind by offering your clients continuous, proactive service—even after settlement.

- Increase Revenue with Repricing Opportunities: Monitor loan rates and initiate repricing at the perfect time to retain clients and secure new commissions.

- Efficient Post-Settlement Management: Save time and resources by automating rate monitoring, freeing you up to focus on new business.

- Prospecting Power: Use RateTraker to engage new prospects, offering them competitive rate reviews as a way to start the conversation.

Why RateTraker Benefits Your Clients:

- Save Money Effortlessly: Clients trust that their broker is always looking out for their financial wellbeing by ensuring they have the best possible loan terms.

- Full Transparency & Control: Clients are in charge of their data and can easily consent through secure open banking.

- Ongoing Support After Settlement: Your clients continue to feel cared for and valued long after the initial loan is approved, reducing churn.

Safe, Secure, and Transparent

At Sherlok, we prioritize data security and privacy. Sherlok’s RateTraker complies with open banking standards and uses industry-leading encryption to protect your clients’ sensitive information.

- Open Banking Compliant

- Full Client Consent and Transparency

- Data Encryption for Maximum Security

Sherlok’s RateTraker Works with Any Aggregator

No matter which aggregator you’re with, Sherlok’s RateTraker is available for you. It’s designed to work seamlessly with brokers across Australia, empowering you to deliver exceptional service to your clients—whether you’re post-settlement, prospecting, or managing ongoing client relationships.

- Post-Settlement Client Retention Tool

- Prospecting for New Clients

- Automated Repricing & Loan Monitoring

Ready to Transform Your Client Relationships and Grow Your Business?

Sherlok’s RateTraker helps you stay ahead of the curve, automate your processes, and keep clients happy—all while saving you time and helping you grow your business.

Sign Up for Sherlok’s RateTraker Today!

Join brokers across Australia who are already boosting client retention, increasing revenue, and offering world-class service with Sherlok’s RateTraker.

Frequently Asked Questions

Sherlok is fully compliant with open banking regulations and uses industry-standard encryption to ensure your clients’ data is protected.

By proactively monitoring your clients’ loans, you can easily identify opportunities to reprice, retain clients, and offer value beyond the initial settlement—keeping clients engaged and loyal.

Yes! Sherlok’s RateTraker is available to brokers regardless of your aggregator, allowing you to provide this valuable service no matter who you’re working with.

Loved by brokers,

here's what they say:

Our Awards