Automated Rate Tracking & Repricing for Mortgage Brokers

We've combined Ratetraking with streamlined repricing and refinancing to make it as easy as possible for you to retain your clients at scale.

Hound and Sherlok have joined forces

Hound and Sherlok are now working together as the leaders in borrower retention and loan book management for Australia’s mortgage brokers.

At the same time, we’re investing heavily in the next frontier: instant home loan applications. This will give brokers and their clients the ability to go from weeks of paperwork to minutes online — turning days into clicks. We believe changing your mortgage lender should be as simple as changing your utilities or telco provider.

For Hound brokers, we’re running weekly Info Sessions to guide you through moving across to Sherlok. Book your spot via the link below. If you’re an investor interested in supporting this technology, please email hello@sherlok.com.au and we’ll be in touch.

Home Loan Spotlight Report

Access invaluable insights to elevate client retention in the mortgage broking sector with our Home Loan Pricing Spotlight Report.

Explore repricing data and refinancing trends across Australian lenders, unveiling effective strategies for brokers and lenders alike.

Optimise your retention tactics for sustained growth in the competitive mortgage market.

(30 MB Download)

Grow your loan book with your existing clients

It can cost brokers up to 5x more to attract a new client than it does to keep hold of an existing one. You’ve done all the hard work to attract those clients, the last thing you want to do is lose them by not being top of mind. Proactive streamlined client retention is how Sherlok can help you keep them.

How do mortgage brokers use streamlined

client retention?

Predict

Sherlok’s AI predicts which clients are most at risk of leaving and prioritises them for repricing first.

Retain

Sherlok will then reprice the at-risk clients’ loan with the current lender to a lower interest rate.

Refinance

If further savings can be made Sherlok’s Instant Refi comparison will generate refinance leads for brokers.

Loved by brokers,

here's what they say:

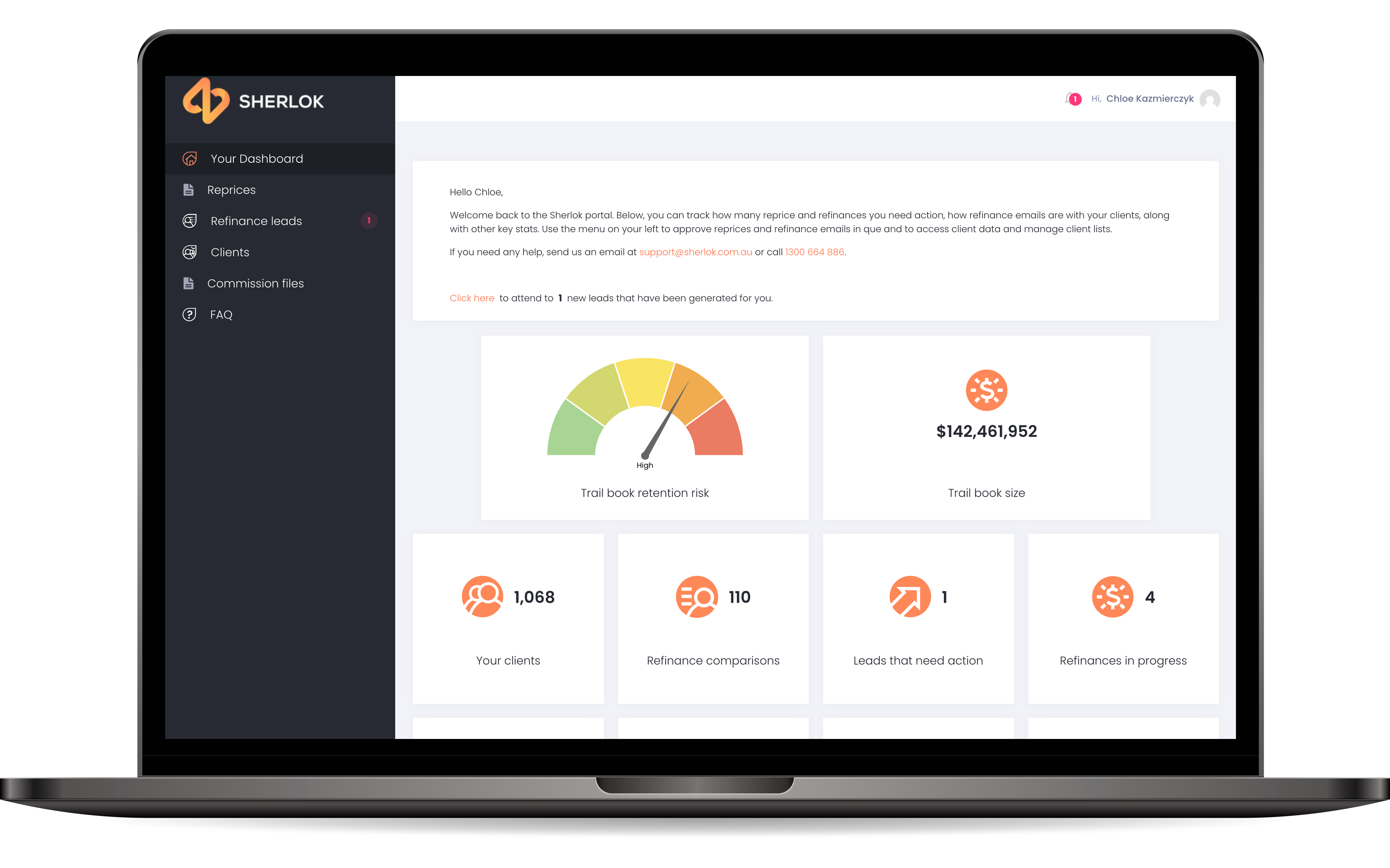

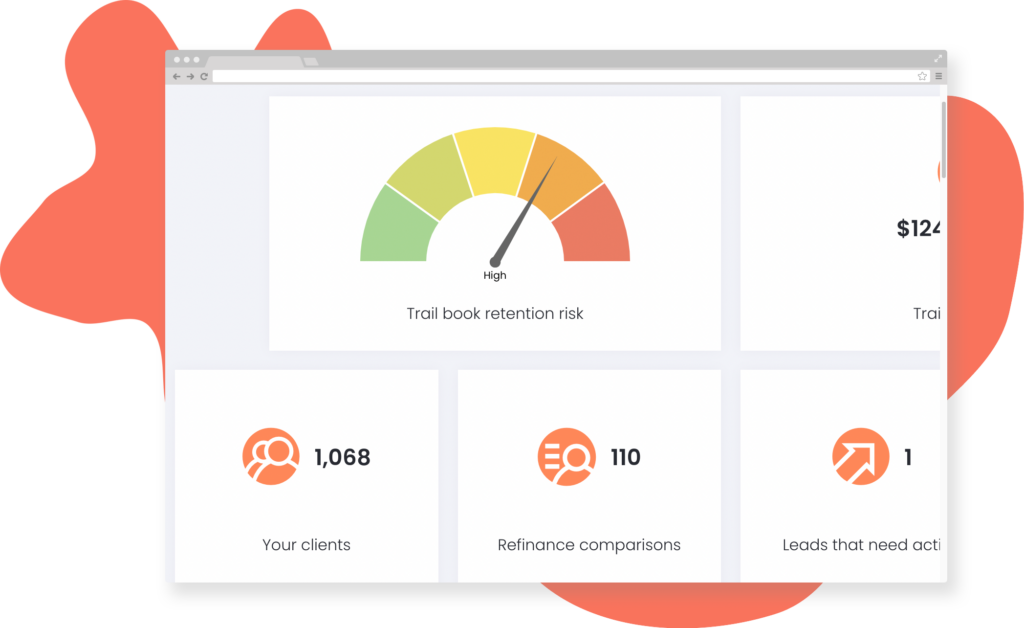

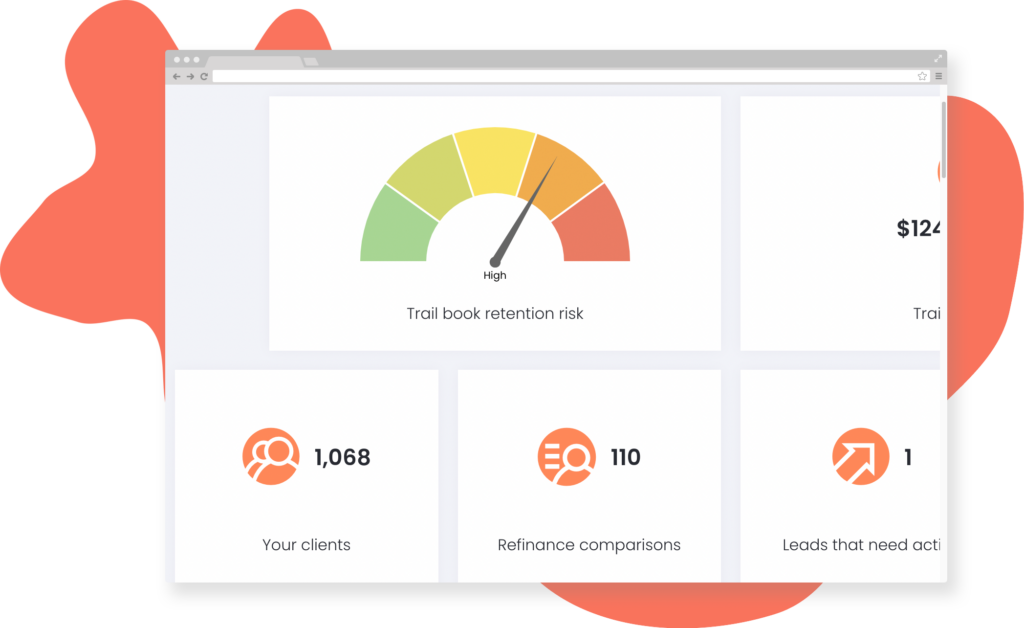

Predict trail book churn

Sherlok automatically analyses a range of parameters for every loan and assigns what we call a Sherlok retention Score.

The Sherlok retention score is similar to a credit score. It’s an algorithm that looks at a whole range of different parameters, and then produces a score for each loan in your Sherlok profile. The higher the score, the higher the risk of losing that loan. A very high score suggests that the client will leave you in the next 12 months if you don’t do anything.

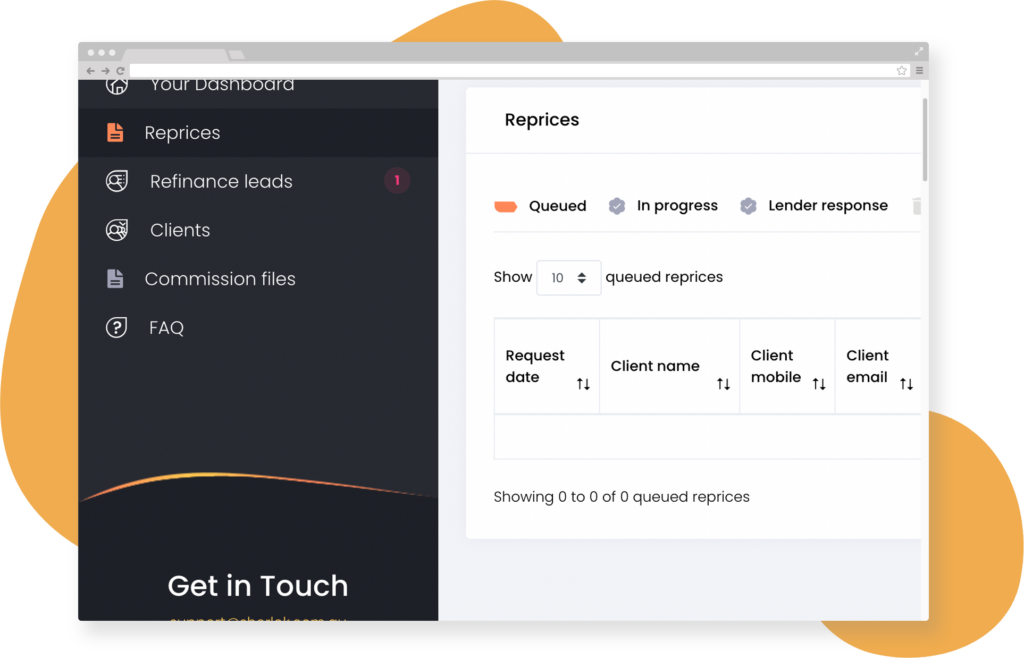

Reprice loans efficiently

Sit back and relax as Sherlok analyses your client list. We monitor your clients’ interest rates to detect when your clients could be getting a lower rate.

Generate refinance leads from your trail book

Sherlok compares your clients’ rates against other lender rates, identifies valuable refinancing opportunities from your existing trail book, and sends these leads straight to your inbox.

Stop losing clients from your back book and experience the power of streamlined client retention.

Our Awards